Page 143 - NGTK2018

P. 143

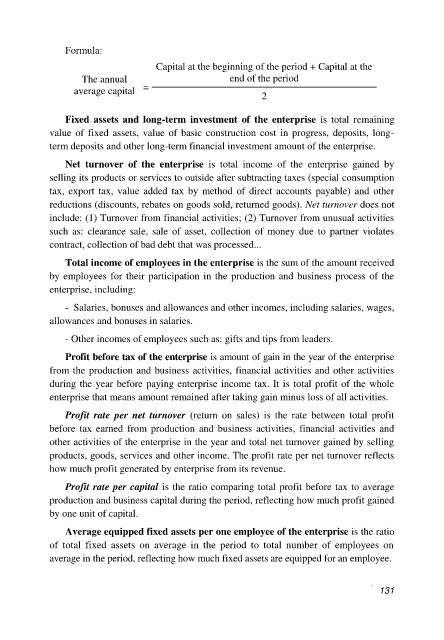

Formula:

Capital at the beginning of the period + Capital at the

end of the period

The annual

=

average capital

2

Fixed assets and long-term investment of the enterprise is total remaining

value of fixed assets, value of basic construction cost in progress, deposits, long-

term deposits and other long-term financial investment amount of the enterprise.

Net turnover of the enterprise is total income of the enterprise gained by

selling its products or services to outside after subtracting taxes (special consumption

tax, export tax, value added tax by method of direct accounts payable) and other

reductions (discounts, rebates on goods sold, returned goods). Net turnover does not

include: (1) Turnover from financial activities; (2) Turnover from unusual activities

such as: clearance sale, sale of asset, collection of money due to partner violates

contract, collection of bad debt that was processed...

Total income of employees in the enterprise is the sum of the amount received

by employees for their participation in the production and business process of the

enterprise, including:

- Salaries, bonuses and allowances and other incomes, including salaries, wages,

allowances and bonuses in salaries.

- Other incomes of employees such as: gifts and tips from leaders.

Profit before tax of the enterprise is amount of gain in the year of the enterprise

from the production and business activities, financial activities and other activities

during the year before paying enterprise income tax. It is total profit of the whole

enterprise that means amount remained after taking gain minus loss of all activities.

Profit rate per net turnover (return on sales) is the rate between total profit

before tax earned from production and business activities, financial activities and

other activities of the enterprise in the year and total net turnover gained by selling

products, goods, services and other income. The profit rate per net turnover reflects

how much profit generated by enterprise from its revenue.

Profit rate per capital is the ratio comparing total profit before tax to average

production and business capital during the period, reflecting how much profit gained

by one unit of capital.

Average equipped fixed assets per one employee of the enterprise is the ratio

of total fixed assets on average in the period to total number of employees on

average in the period, reflecting how much fixed assets are equipped for an employee.

Doanh nghiệp, hợp tác xã và cơ sở SXKD cá thể 131